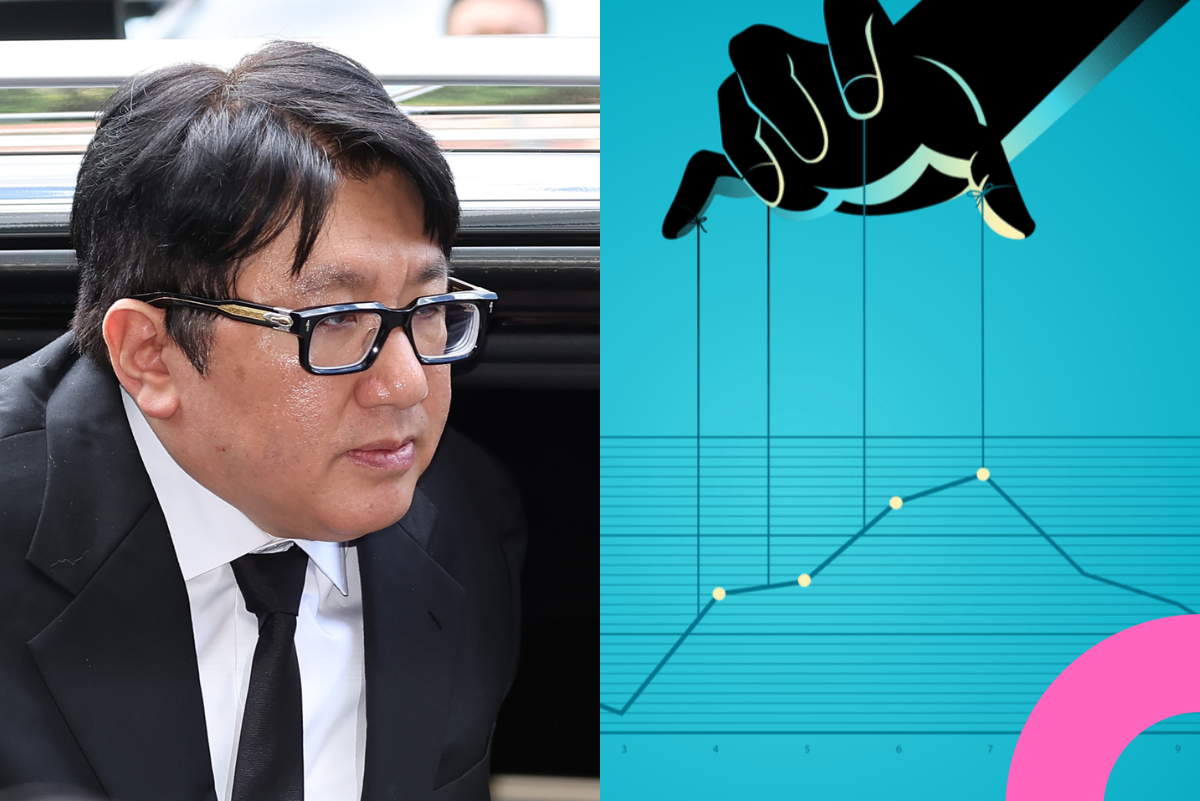

Bang Si-hyuk, Chairman of HYBE Corporation, has been formally accused by South Korea’s Financial Services Commission (FSC) of engaging in fraudulent securities transactions. The Securities and Futures Commission (SFC), under the FSC, alleged that Bang orchestrated a structured fund scheme which misled existing investors, enabling him to personally profit approximately ₩400 billion KRW (~$288 million USD).

According to the SFC, the alleged scheme was designed to delay HYBE’s stock listing, allowing Bang and affiliated funds to manipulate timing and extract massive gains. The total profit involved in the case reportedly exceeds ₩1 trillion KRW (~$719 million USD).

National Pension Fund Implicated

A key concern raised by financial analysts and former journalists, including Kwon Soon-woo, centers on the National Pension Service (NPS)—one of the affected institutional investors. The fund, which manages retirement assets for the Korean public, reportedly invested in the fund structure Bang is accused of manipulating.

“That ₩400 billion didn’t come from nowhere—it came from us,” Kwon emphasized in a widely circulated video. “If this alleged fraud hadn’t occurred, those earnings should have gone to the public via the National Pension Fund.”

Kwon further asserted that public pension institutions must acknowledge their fiduciary duties, and pursue legal claims if mismanagement or deception led to lost public assets.

Legal and Institutional Accountability

In addition to the criminal complaint filed against Bang, attention is now shifting to fund managers and public institutions. If these entities failed to properly oversee or protect their investments, they may face civil liability for damages. Analysts argue that institutional negligence particularly by entities managing citizens’ retirement money—warrants investigation.

Critics argue that many Korean citizens are unaware that their retirement funds could be indirectly involved in this alleged scheme. The potential loss of returns represents not just a financial issue but a matter of public trust.

HYBE’s Response

HYBE responded with a statement expressing regret:

“It is unfortunate that the Financial Supervisory Service did not accept Chairman Bang’s explanation. He actively cooperated with the investigation and denied any intent to profit privately from a planned listing. We respect the authorities’ decision and will fully cooperate with the investigation to restore market confidence.”

As the case proceeds to the prosecution phase, legal experts anticipate broader implications for corporate governance and fund transparency in South Korea. There are growing calls for the National Pension Service to initiate damage claims and prevent future oversight failures.