HYBE has been attempting to issue new CBs to refinance existing ₩400 billion CBs, which become due for early repayment in November. However, the company’s internal and external challenges are hindering this process. If HYBE’s new CB issuance fails, there’s a strong possibility that its stock price could plummet.

On Sep 11th, legal sources reported that the Seoul Western District Prosecutors’ Office summarily indicted Suga the previous day for drunk driving. While the exact fine was not initially disclosed, it was later revealed to be ₩15 million. Despite being a first-time offender, the heavy fine appears to have been influenced by his blood alcohol level at the time of the incident, which was 0.227%, far exceeding the maximum limit. Lawyer Noh Jong-eon from Law Firm Jonjae noted, “A ₩15 million fine for a first-time offense reflects the seriousness of drunk driving.”

Unless the court decides to proceed with a formal trial or Suga contests the fine, his ₩15 million fine will be finalized. Once the fine is confirmed, the legal proceedings regarding his drunk driving will conclude.

Before the indictment, on Sep 4th, Mirae Asset Securities, which is overseeing HYBE’s new CB issuance, highlighted at a company presentation that BTS would resume full-group activities after all members complete their military service next year. Even before the legal ruling on Suga, HYBE had already included him in their plans for these activities. HYBE representatives also expressed confidence that their stock price could rise above ₩260,000 next year, over ₩100,000 more than current levels.

However, Suga’s drunk driving incident has caused divisions among fans. Additionally, under standard contracts used by most entertainment companies, his fine could be considered grounds for contract termination, as activities such as drug use, sexual offenses, fraud, gambling and drunk driving are typically included as reasons for termination. While it’s unlikely HYBE will terminate Suga’s contract, it does raise concerns about how HYBE will handle similar situations with other artists.

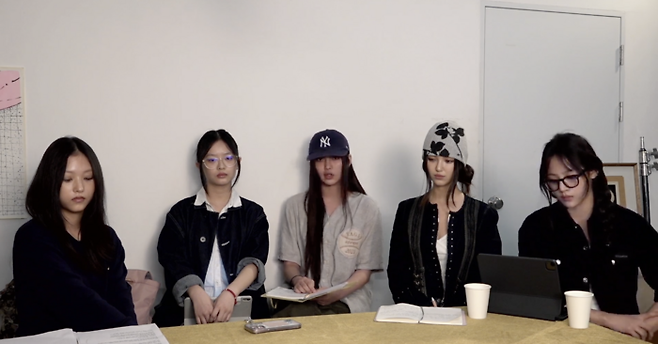

On the same day Suga’s indictment was reported, NewJeans, the only artist under HYBE’s subsidiary ADOR, held a surprise live broadcast, revealing various instances of unfair treatment by the company. During the live broadcast, the five members shared that member Hanni had been bullied by a HYBE manager, and despite reporting this to the new management after the dismissal of Min Hee-jin, they were told there was no evidence. They also mentioned concerns that other members might face similar issues and expressed anxiety over the unauthorized release of trainee videos and medical records.

These revelations come after reports earlier this month that the risk of ADOR’s management transition had been resolved following the appointment of new CEO Kim Joo-young, replacing Min Hee-jin. However, NewJeans’ statement suggests otherwise.

With NewJeans being ADOR’s only artist and a major revenue source for HYBE, alongside BTS at BigHit Music and SEVENTEEN at Pledis, this controversy is a significant setback for HYBE’s new CB issuance.

Investors had already expressed concerns about the unattractive terms of HYBE’s new CBs, which have a 0% interest rate and no reset feature (refixing) to adjust the conversion price based on stock price fluctuations. The structure of the bonds places most of the risk on investors, who would not benefit from a drop in HYBE’s stock price.

While some in the investment community are optimistic due to high liquidity and stable demand for CBs, others point out that the previous ₩400 billion CBs, issued at nearly double the current stock price, have already led to significant losses for investors.

Further complicating matters, HYBE’s focus on the U.S. market through ventures like the group KATSEYE and the acquisition of Ithaca Holdings has yet to yield significant success, and concerns persist over the company’s performance in this market. Additionally, the company faces reputational risks related to its recent scandals and the future of Weverse, HYBE’s fan platform, which has faced criticism for its monetization model.

HYBE’s efforts to issue ₩400 billion in new CBs will be one of the most closely watched developments in the K-pop industry this year.

Source: Daum